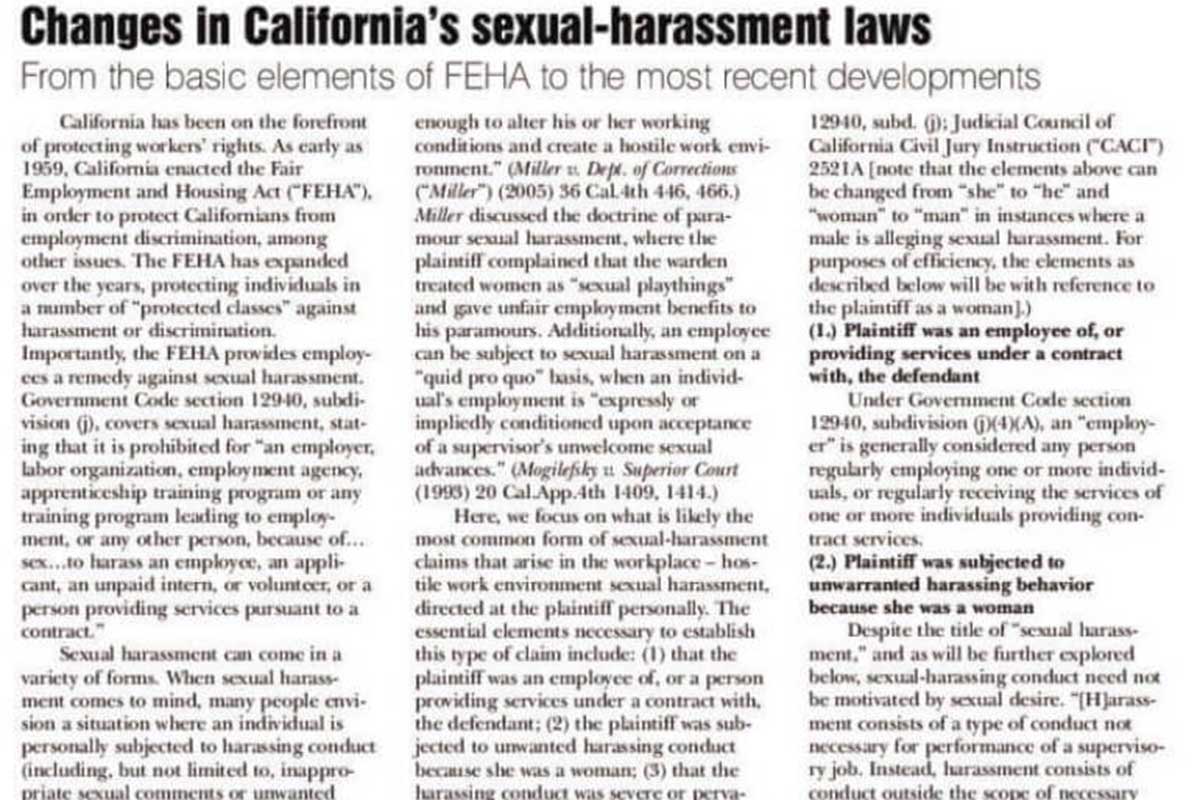

In a significant victory for over 1,700 California aerospace workers, U.S. District Judge Gonzalo P. Curiel has granted preliminary approval of a $19.9 million settlement in a wage-and-hour class action against subsidiaries of RTX Corporation. The lawsuit, spearheaded by Matern Law Group, PC, alleged widespread violations of labor laws, including failure to provide meal breaks, […]

Read More